Elevate Your Practice: AI for Smarter Financial Advice & Accelerated Growth

Tired of administrative burdens eating into client-facing time? Discover how leading wealth managers and financial professionals are leveraging AI to automate, analyze, and scale their services—delivering personalized experiences without adding overhead.

Are These Practice Bottlenecks Holding You Back?

Endless Paperwork:

Drowning in repetitive reporting, KYC compliance, and manual client follow-up.

Advisors Bogged Down:

High-value advisors are spending too much time on administrative tasks, not client relationships.

Missed Growth Opportunities:

Failing to consistently identify and act on cross-sell and upsell potential within your client base.

Rising Client Expectations:

Clients demand personalized service, but delivering it at scale is increasingly difficult and costly.

Time-Consuming Data Analysis:

Valuable insights are buried in spreadsheets, making it hard to proactively manage portfolios or identify trends.

The Optimizing Group AI Advantage for Financial Firms

Optimizing Group empowers financial firms with intelligent AI systems designed to enhance efficiency, compliance, and client relationships:

- Automated Reporting & Compliance: Auto-generate performance summaries, compliance reports, and audit trails, ensuring accuracy and saving countless hours.

- Proactive Client Engagement: Automatically schedule reviews, send personalized follow-ups, and trigger timely communications based on client needs.

- Predictive Insights: Leverage AI to predict portfolio churn, identify ideal upsell timings, and flag clients needing immediate attention.

- Daily Actionable Intelligence: Deliver critical client insights and portfolio summaries directly to your inbox, ready for action.

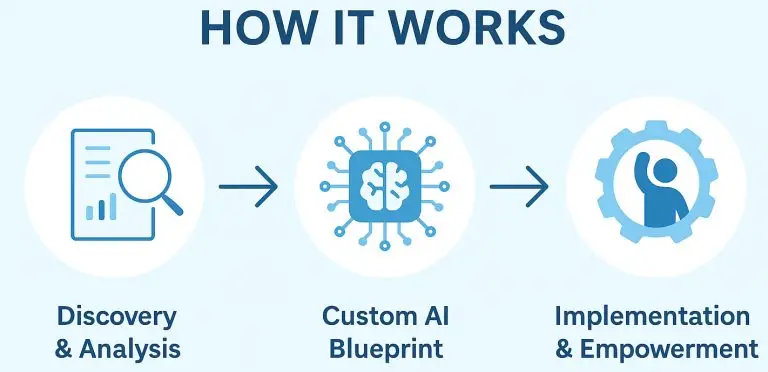

Your Simple Path to AI-Powered Financial Growth

- Growth Strategy & Process Audit: We conduct a deep dive into your current client acquisition, operational workflows, and revenue channels to pinpoint inefficiencies and untapped growth opportunities.

- Custom AI Blueprint for Growth: We develop a tailored AI roadmap, identifying precise solutions for automating tasks, enhancing client engagement, and optimizing your business model for scale.

- Seamless Integration & Empowerment: We deploy and integrate AI tools with your existing systems, ensuring your team is empowered to leverage them effectively, driving immediate and long-term results.

💰 WHAT YOU'LL GAIN

Tangible Benefits for Your AUM & Client Service

✔️ More AUM, Less Admin:

Significantly grow your Assets Under Management by freeing up advisors from administrative burdens.

✔️ Faster Client Response Times:

Deliver rapid, personalized service that builds client trust and satisfaction.

✔️ Personalized Service at Scale:

Provide bespoke advisory experiences to a larger client base without increasing headcount.

✔️Reduced Compliance Overhead:

Automate compliance reporting and data validation, minimizing risk and manual effort..

✔️ Empowered & Engaged Staff:

Free your team from administrative burdens, allowing them to focus on delivering exceptional service.

✔️ Unbeatable Competitive Edge:

Position your Financial Services Firm as an innovator, attracting discerning clients who value modern efficiency and personalized care.

🎁Ready to Build a Smarter, More Profitable Med Spa? Claim Your FREE AI Practice Audit & Strategy Session

In just 60 minutes, we’ll conduct a comprehensive AI audit of your practice. You’ll walk away with a clear understanding of where AI can most effectively reduce overhead, boost revenue, and future-proof your operations. This isn’t a sales pitch—it’s a high-value, personalized consultation

You’ll walk away with:

✔️ A tailored analysis of your biggest inefficiencies and hidden opportunities.

✔️ Specific, actionable AI use cases customized for your practice

✔️ A clear, simple AI integration roadmap to get started immediately.

✔️ Zero obligation to buy. Just expert insight and a pathway to a more profitable, efficient future, absolutely free.

👥 Financial Leaders Trust Optimizing Group

“The AI dashboard from Optimizing Group is like having a virtual advisor assistant. It proactively flags which clients need attention—often before they even call us. It’s fundamentally changed how we manage our relationships and prioritize our time.”

— Sarah Rodriguez, Director, Apex Wealth Management