AI That Closes More Policies: Intelligent Automation for Modern Insurance Brokers

Stop letting valuable leads go cold. Transform more quotes into loyal clients with AI-powered automation that keeps your pipeline moving, personal, and profoundly efficient.

Are These Challenges Limiting Your Policy Sales?

Quotes Going Cold:

Losing potential clients because follow-up is inconsistent or delayed, letting promising leads slip away.

Manual Renewal Headaches:

Drowning in tedious renewal reminders and manual policy tracking, preventing proactive engagement.

Missed Cross-Sell Opportunities:

Limited time and fragmented data make it difficult to identify and act on cross-sell or upsell potential.

High Service Workload:

Too much valuable time spent on administrative tasks per policy, eating into sales and growth.

Pipeline Bottlenecks:

Manual processes at each stage of the sales funnel create inefficiencies and slow down conversion.

The Optimizing Group AI Advantage for Insurance Agencies

Our intelligent AI systems are purpose-built to empower insurance agencies, streamlining operations and maximizing policy conversions:

- Personalized Lead Nurturing: Nurture inbound leads with automated, personalized sequences that engage prospects at every stage.

- Proactive Renewal Management: Auto-track renewal and cancellation windows, triggering timely reminders and engagement strategies to boost retention.

- Instant Quote Comparisons: Generate comprehensive quote comparisons instantly, giving your agents a powerful tool to close faster.

Smart Action Alerts: Our AI monitors your pipeline and alerts your team precisely when action is needed, ensuring no opportunity is missed.

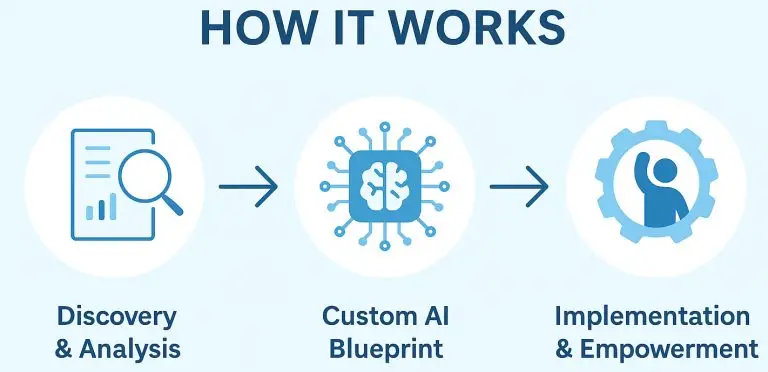

Your Simple Path to AI-Powered Policy Growth

- Growth Strategy & Process Audit: We conduct a deep dive into your current client acquisition, operational workflows, and revenue channels to pinpoint inefficiencies and untapped growth opportunities.

- Custom AI Blueprint for Growth: We develop a tailored AI roadmap, identifying precise solutions for automating tasks, enhancing client engagement, and optimizing your business model for scale.

- Seamless Integration & Empowerment: We deploy and integrate AI tools with your existing systems, ensuring your team is empowered to leverage them effectively, driving immediate and long-term results.

💰 WHAT YOU'LL GAIN

Tangible Benefits for Your Agency

✔️ Higher Close Rates:

Convert more quotes into policies with consistent, timely, and personalized follow-up.

✔️ Lower Service Time Per Policy:

Automate administrative tasks, allowing your team to handle more policies with less effort.

✔️ Effortless Upsell & Renewal:

Streamline workflows for renewals and cross-selling, maximizing client lifetime value.

✔️A CRM That Works For You:

Transform your existing CRM into a proactive, intelligent sales and service engine.

✔️ Empowered & Engaged Staff:

Free your team from administrative burdens, allowing them to focus on delivering exceptional service.

✔️ Unbeatable Competitive Edge:

Position your Insurance Agency as an innovator, attracting discerning clients who value efficient and personalized care.

🎁Ready to Build a Smarter, More Profitable Insurance Agency? Claim Your FREE AI Practice Audit & Strategy Session

In just 60 minutes, we’ll conduct a comprehensive AI audit of your practice. You’ll walk away with a clear understanding of where AI can most effectively reduce overhead, boost revenue, and future-proof your operations. This isn’t a sales pitch—it’s a high-value, personalized consultation

You’ll walk away with:

✔️ A tailored analysis of your biggest inefficiencies and hidden opportunities.

✔️ Specific, actionable AI use cases customized for your practice

✔️ A clear, simple AI integration roadmap to get started immediately.

✔️ Zero obligation to buy. Just expert insight and a pathway to a more profitable, efficient future, absolutely free.

👥 Insurance Leaders Trust Optimizing Group

“Optimizing Group’s AI follow-up system was a game-changer for our P&C funnel. We literally doubled our close rates without needing to hire more staff. It’s the most impactful automation we’ve ever implemented.” — Mark Thompson, Agency Owner, Liberty Shield Insurance